Impact of Coronavirus on eCommerce: Consumers Prepare for Reopening, Sporting Goods and Tourism Get Boost (Update 11)

With some regions of the world reporting declining rates of Covid-19 infections and fatalities, countries have started to communicate their reopening roadmaps, and in some parts of the world, are starting to phase out some of the restrictions implemented over the past couple of months. Spain lifted some of its quarantine measures Monday, as did France, where small stores can once again open their doors, albeit at reduced capacity. And according to the UK government’s Covid-19 recovery strategy, some non-essential businesses will be allowed to reopen on June 1st. In the US, some states have also started lift lockdowns, and Macy’s reopened 68 of its 500 stores on May 4.

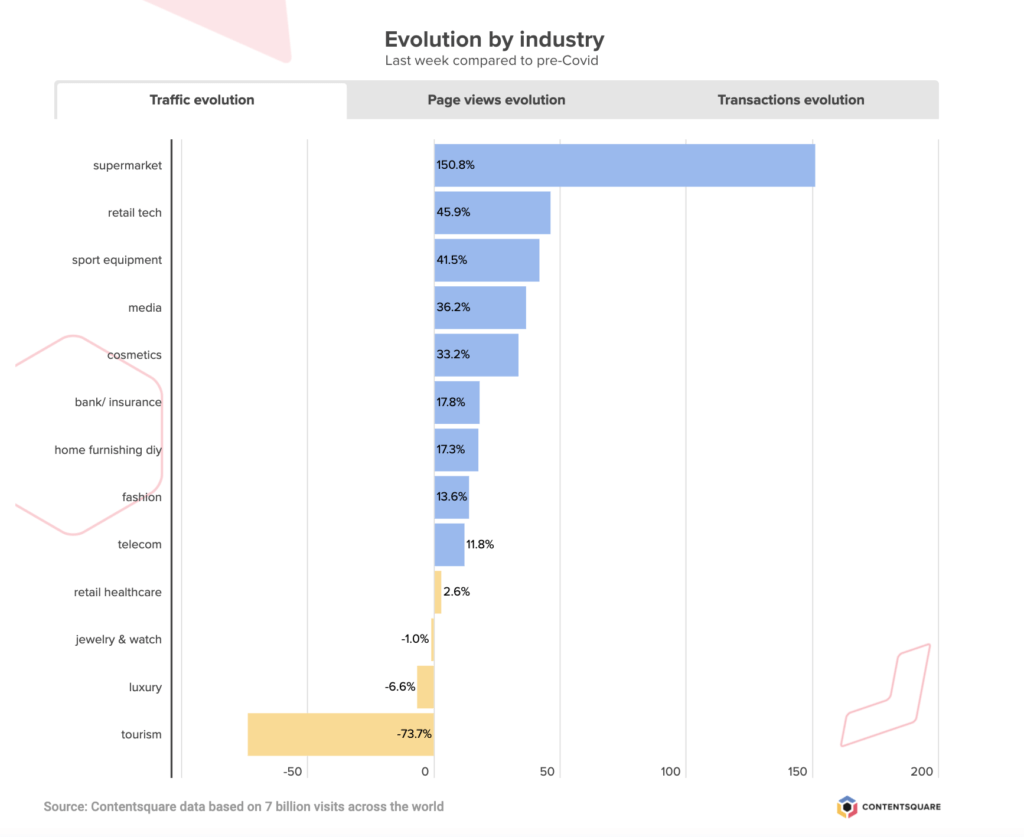

We’ve been monitoring the impact of the unfolding situation on eCommerce KPIs to understand how the outbreak is affecting customer behavior across all industries. To understand the shift in traffic, transactions and customer engagement, we’ve compared a fresh set of data every week to data from the period immediately preceding the introduction of quarantine measures in the West (or, the first 6 weeks of the year, which we call the reference period).

As many countries tentatively reopen parts of the economy, here’s what was happening online this week:

Traffic Surge On Pause For The First Time In 7 Weeks

After weeks and weeks of steady growth, digital traffic was at a standstill this past week. This slowing down of traffic barely makes a dent in the traffic gains recorded since the onset of the outbreak, and the volume of visits is +30% higher today than it was in January and February (reference period). Transactions dropped by a slight -3% this past week, but the volume of sales remains much higher than before the start of quarantine, with a +44% increase across countries and industries. And after a strong rise in early March and subsequent drop, engagement (time per session) is back to almost-normal levels.

As of May 6th, all stores in Germany have been allowed to reopen, which perhaps explains the -21% decline in digital traffic observed over the past week. Digital transactions dropped -17% over the same period, suggesting that many purchases are have shifted back to offline. Overall, despite this correction, the online sales volume in Germany is still up by a significant +48% from pre-crisis level.

With Warmer Times Ahead, Consumers Get Their Sports Gear In

Whether it’s the promise of sunnier days ahead or optimism fueled by the first wave of lifted restrictions, people seem to be gearing up for more sporting (and hopefully outdoor) activities. Sites specializing in sporting goods saw a +10% increase in traffic from the previous week, contributing to a total +41% more visits than before the start of the crisis. Transactions were up +6% from the previous week, translating in +124% more purchases than pre-crisis.

In the UK, traffic and transactions on sporting goods sites both climbed around +14%. France saw a more modest +5% traffic increase this past week, while transactions climbed up +2%.

Second Week Of Double Digit Growth For Tourism Sector Transactions

The travel sector is still reeling from the impact of the Coronavirus crisis, with -74% fewer visits than before the outbreak. And while transactions are down -85% from pre-Covid levels, they are slowly crawling back up. Last week’s +26% increase comes on the heels of a few weeks of slow but continued growth.

France is more severely hit than the UK or the US in terms of traffic, with a -76% decline in the volume of visits (compared to -69% for the UK and -71% for the US). The.UK is suffering the biggest decrease in transactions — -92% compared to -83% in both France and the US.

Domestic travel players are understandably doing better than those offering primarily international travel in terms of transactions, with a -79% drop in sales compared to -90% for international trip planners. In fact, the strongest progression this week came from domestic travel and most notably, vacation bookings (+72% week on week), train travel (+54%) and hotel sites (+41%) while air travel did not progress, showing that consumers are starting to make domestic travel plans for the summer.

In any case, growing engagement over the past month signifies people are tentatively looking to the future and perhaps dreaming once again of their next escape. While the average time per session is still -25% below pre-quarantine levels, it has climbed up +10% since April 10.

Home Decor Consumer Electronics Down As Consumers Move Into New Phase Of Quarantine

Visits to furniture and DIY stores were down -10% this past week, with transactions also dipping -12%. It could be that the wave of home improvement observed back in April has finally subsided, and that consumers have made the necessary adjustments to transform their home space into their everything space. Sites specializing in consumer electronics also saw fewer visits this past week (down -7% from the previous week) and a -9% drop in purchases. Here too, it appears that consumers have moved past the “equipment” phase of quarantine, and are either all set for laptops, gaming and home entertainment, or have their thoughts to other pursuits.

If you want to see KPIs for your industry, be sure to check out our Covid-19 eCommerce Impact Data Hub. It’s updated every Monday with the freshest behavioral data across all sectors.